LoRa vs LTE-M vs Sigfox

- Published

- in IoT

There‘s a battle going on for the infrastructure technology that will support the Internet of Things. Currently the three most talked about contenders are Sigfox, LoRa and LTE-M. There are a lot of other alternatives and it’s quite possible that none of LoRa, Sigfox nor LTE-M0 will win, but that’s another story. If you search for LPWAN (Low Power Wireless Area Networks) you’ll see that the battle for supremacy is a hot topic. It’s largely because of the impending loss of the GPRS networks which power much of today’s M2M business. As a result, almost every day you’ll find another article debating their respective technical merits.

I’m going to argue that these comparisons miss the point. Which technology will win depends far more on the business model than on the underlying technology. The three technologies listed above are interesting to compare, as they exemplify three significantly different approaches to an IoT business, which can be broadly summed up as:

- Sigfox – become a global Internet of Things operator

- LoRa – provide a technology that lets other companies enable a global Internet of Things

- LTE-M – evolve an existing technology to make more money for network operators

Between them they promise to help us get to the predicted 50 billion connected devices in 2020. A winning solution could allow the IoT to take off and make its supporters a lot of money. The ones that fail may be limited to niche applications and lose investors hundreds of millions of dollars. Only one is likely to win. It’s also possible that all of the current pretenders could lose. So let’s forget the technology and look at the business models.

[download id=”2251″ format =”3″]

The Internet of Things (IoT) has been around as a phrase since 1999, when the phrase was coined to describe the potential of RFID. Since then it has evolved to cover all forms of sensors which send data to the cloud, as well as devices which may be remotely operated. That’s not a new market – it’s been around for several decades under the name of Machine to Machine, or M2M. The IoT moniker can either be seen as democratising it beyond the vertical sectors of M2M, or as a cynical attempt to revive a flagging M2M market by introducing a more exciting name. Back in 2009, the acronym was brought from relative obscurity into the mainstream when Ericsson made their prediction that by 2020 there would be 50 billion connected devices. Most people missed it, as it was hidden away on page 125 of their annual report. The next year they fleshed it out in the document which changed the industry mindset – their seminal briefing paper “Towards 50 Billion Connected Devices”. Network operators in particular seized upon it like a pack of starving hyenas as proof that there would be revenue after smartphones. From that point every operator presentation highlighted the opportunity that the Internet of Things would bring to their business. Most believed the 50 billion. Some analysts set it lower at 20 billion, others suggested it could be as high as 1.5 trillion. Everyone blindly assumed it would mean much more revenue.

Even in the first Ericsson document there were provisos about what would be needed to get to the 50 billion. They highlighted the fact that network operators would need to “combine technology with services for lower cost, faster time to market and reduced project risks”. They also made clear their view that success would come from “leveraging service providers’ continuous investments in network build-outs and upgrades”, adding that “M2M industry verticals can tap into the best and the latest of fast-moving mobile innovations”.

Unfortunately none of that happened. M2M deployments stubbornly stuck to GPRS and 3G and the focus within the 3GPP standards group was on more data and capacity to meet the demands of consumer-led mobile broadband and video. Although the headline of 50 billion continued to be quoted as a hoped-for inevitability, none of the foundations were put in place. In this year’s mobility report Ericsson downgraded the 2020 figure for connected devices to around 28 million. The more shocking change (which I’ll cover in a future article) is that the number of them expected to have cellular connections has dropped from around the 40 billion number of their 2010 projection to just 1.2 billion.

As it’s become increasingly obvious that the cellular industry has taken its eye off the M2M and IoT opportunity, interest has grown in alternative LPWAN networks. That’s produced a flurry of reports where analysts and technical advocates have debated their respective technical merits. The problem with technology comparisons is that it inevitably comes back to “which is the best technology”, with proponents all insisting that their favourite “best technology” solution will win. These are frequently the same technically blinkered commentators who in previous times waxed lyrical about Betamax VCRs, Sega Dreamcasts, Psion Organisers and Quadrophonic stereo systems. The reality is that best doesn’t matter. It doesn’t matter because, particularly in the case of mobile, the technology is primarily there to make money for network operators. It needs to be reliable enough to sell contracts, which is what pays for investment in infrastructure. For them, technical specmanship plays second or third fiddle to ease of deployment and the ability to bill. It is a sign of how little the M2M and IoT industry has evolved past a fixation with hardware that they fail to see this. That fact in itself does not bode well for getting another 40 billion devices connected.

This is where we need to look at the economics. The vast bulk of IoT connectivity has a very different trajectory of requirements to consumer mobile. Smartphones have changed the dynamic of mobile ownership. Consumers are increasingly prepared to pay more for a smartphone, and in many cases replace them more often. But at the same time, they expect more and more data for the same contract cost. Networks have effectively become pipes.

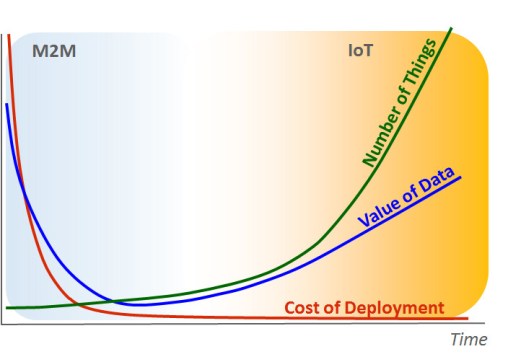

M2M customers, who are the vanguard of the IoT sector, generally want very little data. Some products, like automotive and security do some fairly hefty streaming, but the perceived view of the mythical 50 billion connected devices is that the vast bulk will send and receive a few hundred bits of data every few minutes. At the moment the value of that data is relatively high. It needs to be, as deploying M2M devices is quite expensive, which is why they’re confined to a small number of vertical applications where the business model supports the return on investment and ongoing running costs.

The graph above illustrates the dilemma that the industry faces in moving from these bespoke M2M applications to the ubiquitous world of IoT and billions of connected sensors. The red line shows the cost of deployment. That’s a combination of hardware price, network charges and the cost of installation, which we’ll look at in more detail in a moment. To get to scale, the overall cost of deployment needs to fall. What may be cost effective for a delivery fleet won’t be cost effective for a washing machine.

The impact of falling cost in driving numbers up is pretty obvious. The blue curve is less obvious and more interesting, as it charts the value of the data. At the left hand edge of M2M applications the value of data is high. As I said above, it needs to be in order to support the return on investment for these applications. What is generally not appreciated is that as the cost of deployment falls, so does the value of the data that is generated. What happens here is that as sensors become cheaper and less application specific, value will be generated either by building up long term data (as in plotting the failure modes of washing machines), or combining data from multiple sensors (such as in smart city applications). Because it will take time to get enough sensors deployed, or to harvest enough time-series information, it will be several years before the value generated per sensor starts to rise again. To put it another way, the deployment cost has to be low enough to allow the sensor infrastructure to be built up and provide a critical mass of data before we see the financial benefits. It’s not until we reach that point, when value starts to be returned from the data, that we start to see the hockey stick of IoT deployment numbers.

It’s useful to dig down into the detail of deployment costs, as they underlie the economics. Starting with hardware, we currently have cellular or LPWAN modems that cost $10 or more at moderate volumes. That price is one of the reasons why M2M deployments have been limited to those with a robust return on investment case. The lowest cost is for GPRS modems, but as these disappear and companies get forced to move to 3G or 4G cellular alternatives, the hardware cost gets more expensive.

There’s an oft-repeated mantra, which is probably true, that the hardware cost needs to get down to $1 for the IoT to take off. That ought to be possible for most LPWAN solutions, as in general they have been designed so that they carry little baggage. The different owners need to work out how much IP they will licence or give out, particularly LoRa, where Semtech holds the reins on the radio, but those are soluble problems. LTE-M has more of an issue. As it is a subset of LTE and is designed to coexist with other LTE users, it still needs to carry a lot of additional silicon and protocols to allow it to coexist with them. To make an analogy, if you think of 2G as a Model T Ford, 3G would be a Volkswagen Golf / Rabbit and LTE a BMW 7 Series. Like the BMW, there’s a reason that LTE modems are expensive – they’re complicated. However much of that complexity you try to strip out, you’re still going to have an expensive BMW of some form, whereas what you’re after for your IoT analogue is just a well-designed bicycle. Until the telecoms standards get to the p

oint where they can throw most of the baggage away and start with a clean piece of paper, any cellular product will have a cost issue. NB-IOT – their “clean slate” approach may deliver that, but it’s still a long way away. Incidentally, their claim that it will be ready in March 2016 is one of the biggest IoT fairy tales I’ve heard this year.

Most analysis of the market stops with the modem cost, but hardware is the easy bit. The next element of deployment cost is the provisioning cost. Within provisioning I’m including the cost of attaching the unit to the network, the cost of maintaining it and the cost of billing it. I’ll come to the cost of data later.

Today almost every M2M device includes a SIM card. The cost of procuring the SIM card for an M2M application, getting someone to physically put it in the SIM card slot and then verify the network connection usually costs upwards of $25. As the same engineer is probably also physically installing the device, which takes 30 minutes or more, that’s lost in the overall installation costs, so no-one really appreciates it. But the prospect of tens of millions of SIMs being fitted into devices every day to get to our tens of billions is a non-starter. The IoT needs products which are taken out of a box, turned on and just connect and work. For LTE-M that means eSIMs, which are still only supported by a few networks. Both cellular and LPWAN networks need ways to register devices automatically, so manufacturers can buy services for multiple units which they pre-provision.

All of this implies a new generation of billing mechanisms which are paid upfront. These don’t really exist yet and will take time to develop and deploy. The cellular industry has not got a good track record of innovation in billing, so I don’t expect to see these deployed at scale for five to ten years. LPWAN providers also need to start with this new model. They should be faster to support this as they’re not constrained by their existing systems, but it will still take time. If we want billions we need a totally new approach to provisioning, where we can get this cost down to a few dollars per unit.

Perhaps the most controversial part of the deployment cost is the data plan – the cost to transfer data from the device to the cloud.

Low rate, cellular data-only plans have fallen dramatically in cost in many countries – I’ve seen some as low as $0.30/month being offered, although other operators are still trying to get upwards of $100/year. I would contend that if we want to get to the tens of billions of connected devices, data costs need to be free. That may sound shocking, but there are several good reasons for it:

- Once you have tens of billions of sensors connected, the absolute value of data from most of them will be close to zero. Adding a dozen extra sensors in your street may help the value of an application, but the value of the data from any one sensor is miniscule in its own right. If you had to pay for it, it would not be worth installing the sensor.

- When the data revenue falls below a few dollars per year, it costs more to monitor and bill it than you get back, so it’s cheaper not to bother with billing it and just take your revenue up front, and

- No consumer is going to sign multiple contracts for dozens of devices – there just is not a business model.

That argues, at least for the very low throughput devices which will make up the tens of billions, that the provisioning cost includes data for life. The network simply routes the data through to the cloud and takes it as a minimum up-front cost. Ideally, provisioning that will be blown in the chip, so that each piece of silicon comes with it. How that gets shared between operators is an interesting challenge, but it shouldn’t be insurmountable. Coming to agreement will certainly keep plenty of lawyers busy for the next few years.

It should be possible for a device to negotiate and “buy” additional data or services once it’s connected by requesting a data upgrade from the operator, who will bill those pre-approved charges to a user, who could be a manufacturer, service provider or end customer. But that is application specific.

Put this together and you have a vision of a single chip which can be built into anything from a washing machine, an agricultural sensor, a cattle tag, a smart meter, a dog collar – anything that needs connectivity. As soon as it’s turned on it connects, transfers data and continues doing so for as long as the device remains working. The chip vendor and the network operator get paid upfront and there’s no ongoing costs, other than processing the data by the ultimate service provider. It gets the cost of connectivity down to a few dollars. Only then will we start to see the growth moving into billions.

This is totally different to current M2M models and operators’ understanding of the IoT. I’ve sat through numerous presentations by cellular operators and infrastructure providers who trot out the 50 billion device number on one slide, followed by data revenue projections of $50 – $100 per device on the next slide, oblivious to the simple arithmetic folly of these numbers – they’re claiming an IoT service revenue which is getting on for 10% of global GDP. I don’t disagree with Ericsson’s new projection that cellular M2M will probably only account for 1 billion connections by 2020. Until we can get to an upfront, all-in cost of just a few dollars, which includes data for the life of the hardware, we are not going to see ubiquitous sensor connectivity at scale. All we will see is more vertical M2M, with IoT waiting for the distant future. What’s interesting is that the resulting operator IoT model looks rather like a hardware model of one single upfront payment. But at least that means they can forget about churn, as it’s a prepaid subscription for life. Revenue comes from the volume of devices, not the volume of data.

So where does that put our contenders? Assuming that each are good enough for the majority of applications, which they seem to be, the choice of which will win, or perhaps more importantly, of which will fail, comes down to the business model. I should add that although Sigfox and LoRa are getting all of the press at the moment, there are plenty of other equally credible contenders, such as Ingenu (the network formerly known as On-Ramp), SilverSpring’s Starfish, Cyan’s Cynet, Accellus, Telensa, nwave, Waviot, etc., etc. Unlike Sigfox, LoRa and LTE-M, some of these are already supporting multi-million device deployments – they’re just not making as much noise about it.

LTE-M has a big advantage, which is that the infrastructure is potentially already there. Most LTE base-stations can be upgraded to support LTE-M, so it’s a no-brainer for network operators. The more pertinent question is when chips will be available to make low cost devices? Qualcomm has come to dominate the market for cellular baseband chips. It owns an extensive range of patents and has been driving innovation and complexity to force up the entry barrier and maintain its leading market position. Until very recently it has shown little interest in ultra-low cost, simple cellular chips. In fact it has largely destroyed the market for them. As a result there are no established competitors for LTE-M; the two main companies are both start-ups – Altair and Sequans. Qualcomm has just announced an offering, but the channel to support and sell to tens of thousands of different product companies is very different from their traditional one of working closely with a very few, very high volume manufacturers. LTE-M also contains a lot of IP, a fair chunk of which is owned by Qualcomm, which could prove problematic for new entrants. So even when chips arrive, the ability of any silicon supplier to support their integration by multiple manufacturers will be challenging. However, because LTE-M is building on an established platform with a well-developed migration strategy the infrastructure will get deployed. The only question is how much it will get used, because of silicon availability.

At some point, LTE-M will probably be overtaken by NB-IOT, which should be a cheaper alternative, at which point some networks may start to turn off their LTE-M support. This will take years, if not decades, and needs new billing and provisioning systems. So although it may be the eventual winner, the path there may be a fraught one.

To be honest, if both paths weren’t so fraught, operators would not be flirting with Sigfox and LoRa, but they’re well aware of the impending hole as GPRS disappears, hence they’re grasping at contingency plans. They’re more afraid of losing out than making the wrong choice.

Taking Sigfox next, modules can be implemented with chips from a number of vendors and there should not be a problem with reducing the hardware cost as it scales. However Sigfox have high expectations. They want to be the global IoT network, running the core service behind every device. They are doing deals with operators to roll out networks, but all of the data comes back to Sigfox servers which then forward that to the individual companies who have deployed devices. The good thing is that the service should be the same everywhere. The flip side is the risk.

Aiming to be a global operator is an immense and somewhat narcissistic ambition. No cellular operator has managed it, although several have spent tens of billions of dollars in failed attempts. Although Sigfox’s technology is a much simpler proposition than a mobile phone, the business issues don’t necessarily change much. Sigfox is well funded. They have raised around $150 million and their investors probably expect them to be the first French unicorn. The question is what happens if they run out of cash? The network could disappear overnight. No-one can tell whether or not they will succeed, but it is a high risk strategy.

LoRa takes a different approach. The technology is owned by a chip company – Semtech, who acquired it from another French startup – Cycleo. Semtech has formed the LoRa Alliance, which develops the higher layer protocols and makes these available under a royalty free license to members. The LoRaWAN protocol defines how devices are interoperable and how data is transferred by whoever is running infrastructure back to the device owner.

A key difference from Sigfox is that anyone can run infrastructure. Like Sigfox, the LoRa Alliance is out pressing flesh with operators to get them to deploy LoRa networks. But anyone can buy a LoRa base station for a few hundred dollars and set themselves up with a network. Companies can treat it as a private network. Individuals can do it – there’s even a crowdfunded initiative – The Things Network, which is deploying a crowdsourced LoRaWAN infrastructure. How well all of this will work together is yet to be proven, but it does allow a company to install their own network if they have a business model to support it, letting them decide where they want to run things. That works very well for localised, as opposed to national deployments, but many applications start that way. It also gives the confidence that if your LoRaWAN infrastructure supplier stops supporting LoRa for any reason, you may be able to rescue your application by installing your own base stations at relatively low cost.

The longevity of the network is something that anyone should take very seriously. In the early days of M2M nobody even thought about the fact that GPRS might one day disappear. It is about to do so. Each generation of cellular is proving to have a shorter working life and that may be true for LPWAN as well. It’s a point which Ingenu quite rightly highlight in their marketing presentations, claiming that have an unparalleled network longevity of 20+ years. If true, that will almost certainly be longer than LTE-M.

Going back to the three business models, we can now add some more detail:

Sigfox wants to become a global Internet of Things operator. It’s a high risk approach and it means that there is a single point of failure for anyone using them. It is low cost, it’s available today, but there is a long way before we know whether they have succeeded in their goal. They are VC funded, so the investors will want to make a return or eventually bail out. That, more than the technology, may determine their longevity and what comes afterwards. But if the path looks rocky, they may change their business model to survive.

LoRa is a more distributed concept. Semtech is a well-established, stable chip company. They’ve invested in the standard and are supporting a multitude of partners to provide hardware and infrastructure. They’re letting mobile operators roll out infrastructure, as well as allowing it to be used for public and private networks. How that all connects together is yet to be proven. Each partner is essentially independent, so can succeed or fail. Semtech are the sole supplier of the radio chip, so will end up making around $0.50 on every device that is sold. If volumes reach a billion a year that more than trebles their revenue. Even if it fails as a global network and ends up as a lot of private networks, they still make money selling chips, so there’s no one point of financial risk. You’ll probably be able to build LoRa devices for decades.

LTE-M is there to add more revenue to the operator balance sheet. However, as we’ve seen above, that may not be very much. If the IoT is to succeed, then operators will need to develop a very different pricing and billing strategy, which they may decide is not worth it. That’s also true for the LPWAN options. Where LTE-M has an advantage is that it will come as part of a regular infrastructure upgrade, so support for it just happens. The challenge for volume is getting the hardware price down, where a whole new wave of chip suppliers is needed to disrupt the monopoly that Qualcomm has generated and then to support a diverse range of manufacturers. This takes time. The same thing happened with Bluetooth Low Energy and took at least five years. That was with a far simpler chip with fewer IP issues and a much smaller protocol stack. In theory infrastructure suppliers could configure base station radios to support LPWAN standards, but they are probably too wedded to the 3GPP specification process to want to bring in external, proprietary standards.

Where would I place a bet if I was developing an IoT product? Probably with LoRa, purely because it’s an option which is here today and one where I have control over the infrastructure. It plays to applications which are in confined geographic areas, and in time may provide more national coverage. If national or international coverage is important, then it probably needs to be LTE-M. The Sigfox options leaves too many aspects outside my control with no back-up plan.

If another LPWAN offering comes along, will that change my mind? Probably not, unless it had a compelling local infrastructure, which is a powerful consideration. There’s not much in the technology to differentiate them – it’s all down to the business models behind them. Everything else I’ve seen adheres to one of those three basic models, so choose the one that’s right for you. All three of Sigfox, LoRa and LTE-M are likely to be temporary solutions. We’re only having this debate because the network operators and standards groups screwed up by forgetting M2M and data. At some point they should correct that – it might be NB-IOT, or something even better, but that doesn’t help companies trying to make products that they can deploy today.

All I can advise is that you think about your product needs, where you will deploy it, how long you need it to work for and what your mitigation strategy is if your network coverage goes away. Forget the tech. Your customer will want IoT because of the value of the data and its reliability. And that’s all down to how much you trust your network supplier.

Finally, I cannot overemphasise the importance of bundling data for life into the initial product price – it’s the only way that we will get to volume. It’s just too expensive to manually provision devices at this scale and then bill them for low value data. If you can’t do that at a sensible cost then you’ve probably either designed the wrong product or are working in a traditional M2M vertical sector, where LPWAN and LTE-M are unnecessary distractions. But once again, it’s not about the technology. LPWANs and LTE-M will live or die by their business models.

Thanks. It’s nice to know that the crystal ball works some of the time.

Great article, we re now in 2017 and still most of the things you predicted remains true. Great vision. Congratulations, it was very instructive for me to read it.

Nick, This is by far one of the best articles I have read on IoT even though it is a bit dated. I have also read your updated article published in Dec 2016. I can’t agree more with your conclusions about the Business models which lead to taking this market to the next level. You do refer to some of the alternative technologies requiring no infrastructure i.e. Meshed networks where the likes of Wirepas have adopted a radio-agnostic approach and once-off for life business models. I will be very interested to receive your comments about such alternatives. Kind regards and thank you

Thanks. I’ll be posting a few more articles on LPWAN and NB-IoT this week.

Excellent summary Nick. The business models that drive technology, and their potential longevity, are often overlooked as companies, particularly smaller ones grapple with system design choices.

Very interesting article and debates.

To me seems obvious that any existing operator competes with SIGFOX operator, this means that they adopt LORA or other and deploy their infrastructure.

This will only end by collapse of an operator or standardization with open Technologies.

Looking backward in my senior engineering life, I saw at least 2 big standardization battles like this: GSM/LTE which won over CDMA and Wi-Fi which won over HYPERLAN, but in both case the technology prevailed on the market before being adopted for Standardization.

In case of many technologies and fierce adopters, the standardization process was longer as it used to be for example with PLC, at the end Homeplug won in the Home networking. Coexistence with PLC-G3 ( IEEE P1901.1 and IEEE P1901.2 standards), proves that application field of application is also the natural frontier between technologies.

So far instead of prediction , fair and practical use of technology should be sufficient to go through, not avoiding risk neither success.

I would add that a membership fee of $3k is not significant for any real company. It might deter makers and hobbyists, but that is not where the IoT will come from.

Short LPWAN update from Germany:

In Germany we have at least three companies, who plan to role out a LPWAN. Two of them are on LoRa. One of them is backed by a big utility company. However a standard IoT system integrator will get not an access to the public LoRa networks easy.

Based on that I ordered my own SIGFOX Mini BTS. Everybody with a serious business concept can get one. My customer in Ireland got a SIGFOX Mini BTS as well. We got a very fast role out of SIGFOX in region Düsseldorf and 20 cities shall got a indoor coverage. Moreover I got my hands on SIGFOX module

– 21 dBm @ 3,6 Volt

– 0,05 nA @ OFF

– 7 nA Idle

– 64 KB Flash for my own code

– SIGFOX protocol and encryption on the SoC

– PA with up 21 dBm on SoC

– Small footprint 19 mm x 13,5 mm and the option to get the plain SoC as well

– AT Command Interface on UART

– Migration path from 2G, 3G, 4G module to SIGFOX => kick cellular from the PCB and place a SIGFOX module

The operating voltage of my GSM modules is 3,4 to 4,2 Volt. The SIGFOX module is from 2,5 Volt to 6 Volt. A redesign will be pretty straight forward. End customers like city council are asking for SIGFOX and LoRa even when it makes no sense because there is no LPWAN coverage.

With the new SIGFOX Mini BTS concept everybody can generate the SIGFOX coverage they like. On LoRaWAN we still talk and on SIGFOX we do.

The article of Nick names:

– Price for the node

Nothing is cheaper than the new SIGFOX module or SIGFOX SoC. Everything is on on IC (PA + transceiver + MCU + SIGFOX stack + space for my own code). There are 5 components plus matching circuit to the antenna. I plan to match on the PA direct, because I do not care on the impedance. If necessary I will design a 200 Ohm antenna.

On LoRa I am struggled to order from Semtech. The LoRa IC is no SoC. I need a host MCU always. Inside a LoRaWAN module is often a ARM MCU. In front of the module is another MCU. There are a lot of parts around, the power consumption in off mode is higher, the board space is bigger and the time on air to send 12 bytes is longer. Longer time on air means longer time for the high TX current.

– Access to LPWAN network

To make a long story short. Here in my small village is no LPWAN coverage, but with SIGFOX I can make the wish of city council real.

– Member of LPWAN association

“Device manufacturers must be a member the LoRa Alliance to be LoRa Certified and must use one of the accredited LoRa Certification test houses to do the functional protocol testing.”

Source: https://www.lora-alliance.org/Products/Certification-Overview

Adopter Level: $3000

Source: https://www.lora-alliance.org/Join/Become-a-Member

At GSM, UMTS and LTE I can do what I want. On NB-IoT (LTE-Cat-NB1) I need no membership as well. I am not aware that SIGFOX will asked for a member fee. However Euro 3000 is a lot of money for small companies.

What is going on in other countries? What is the status? Who is moving faster – LoRAWAN or SIGFOX?

And correct me if I am wrong. I am a human and not the Oracle of Delphi.

Really great source of info for anyone impatient enough to keep up with IoT development.

Waiting forward for the update on the article.

Very good,

Strange you should say that. I’m hoping to complete a follow-up article later this week.

Very insightful article. With 18 months passed since the original publication, it may soon be time for an update. NB-IOT has been ratified, but we don’t know when networks will really roll out, or when device chips will be available for development. Sigfox now has a number of network deployments and hence some evidence of business success. LoRa also has more runs on the board with public and private deployments. However, we can’t say that the pricing model has yet been proven for the long term for any of these.

Really good and informed summary of both the tech and commercial aspects of these competing solutions.

Great guidance… Thank you

Every company claims that they are the IoT leader, and given the low number of real IoT installations and the the fact that every company has a different definition of what IoT is, it’s difficult to tell who is telling the truth. Sierra are predominantly a supplier of cellular modems and a major supplier in the M2M market. Like other cellular modem suppliers, they believe that their experience and customer base gives them a major advantage in the IoT space. However, that’s reflected in the marketing of almost every module supplier.

Where does Sierra Wireless Inc fit in this? I heard that they are the IOT leader

At some point over the next month I want to get around to writing more about the different business models. Right now we’re at the interesting point where the emphasis is either on the technology or promoting the brand, neither of which necessarily play to the future success of any variant. The good news is that both Sigfox and LoRa allow disruption and the cellular market is going to have to learn to live with that. That is something new for cellular operators, most of whom have no staff left who understand what real competition is outside their own industry, which is all about brand. So the stakes are very high. However that plays out, I expect the connectivity options for IoT in ten years’ time will be very different from what most players envisage today. So good luck with whatever you do.

Great article. We are more focused on lora as wish to have control of our system, but having just attended a sigfox webinar, can see a role for it in the marketplace also. We will probably also design products using sigfox.

A great article, I was nodding in agreement all the way through. I’m convinced the business models will determine the success of the various technologies, but all too often we leap into the details of the technologies first. This is a refreshing and insightful approach. Thanks for sharing it.

Jean-Paul, Nick, 802.15.4g in its MR-OQPSK flavor does offer very robust physical layer performance. For instance -124dBm for 6.25kbps in 100kHz, which slightly outperforms Lora.

Weightless-P physical layer is very similar to 802.15.4g OQPSK, though it extends downwards with 12.5kHz supporting down to 625bps (and expectedly -133dBm, similar to Lora at 300bps). Moreover, it adds MAC and RRM layers suited to imfrequent uplink-dominated small-payload traffic, which may be a better fit than Wi-SUN choice of 6loWPAN.

I know the whole point is that technology is not the main criterion, but I thought it was still worth mentioning.

Regarding NB-IoT, you say “…This will take years, if not decades, and needs new billing and provisioning systems. So although it may be the eventual winner, the path there may be a fraught one.”

What evidence do you have it requires new billing and provisioning systems?

AFAIK, the details are sorted mostly at the RAN layer, with some impact in the EPC, but that shouldn’t require new billing and provisioning.

LoRa, on the other hand DEFINITELY needs bespoke BSS/OSS integration for every deployment. This is one of the biggest barriers to adoption, imho.

Nick great article!

We http://www.loriot.io are also focusing on LoRa. It feels like a race, who is going to do it. We are pretty convinced that LoRa is doing very well and it’s gaining more and more market share.

Since last year in summer the demand for private server solutions (which is what we offer) has raised dramatically.

LTE will be a competitor but we also think that they will have their issues with the pricing which is going to be much higher than the pricing for LoRa and/or Sigfox. As Nick is writing which technology is going to be used will depend on the use case.

On our homepage everyone is invited to create his own LoRa account to connect completely for free one gateway and 10 devices.

JS

I think that IoT idea goes far beyond a simple matter of telecom thing.

Today we have LoRa tech, Sigfox tech and brand, LTE-M.

In 10 years we’ll have > 100 GHz affordable technos (short range) or maybe ELF technos (why not?) and IoT will always be there – with even smaller things maybe nanothings –

Think of Google Loon project.

It’s important not to confuse great ideas/concepts and technologies.

Technologies sport ideas and ideas use to transcend technologies.

db

The 802.15.4 standards are very much a toolbox of things you can do with low power radios in the ISM bands. ZigBee and Thread both use variants of it, as do a host of other protocols. The most recent version provides even more options, allowing applications to configure the radio for almost any variant. It can be argued that it would have benefitted from a stronger chair who limited it to a simpler set.

That diversity could be claimed as part of the reason for 802.15.4g, which tried to cut down the options for utilities. It still uses the same ISM bands, but most of the interest is in the sub-GHz bands at 868MHz or 915MHz, depending on where you live. (Fortunately smart meters are not very mobile.) It has been optimised for long range, with claims of up to 20km. With -127dBm sensitivity, it’s not quite as good as LoRa, which quotes -137dBm, but in an urban environment that’s not going to make a lot of difference.

As I’ve said in the article, which standard wins is not likely to be about technology; it will be about the business model. Any LPWAN network needs infrastructure and infrastructure management and ongoing specification development (i.e. who fixes the spec and what happens when it gets hacked?). Without that, you have to consider it as a private network, with all of the costs that they involve. A lot of the drive to 802.15.4g always felt as if it was inspired by the utility industry’s traditional approach of wanting their own walled gardens, where they had their own network which no-one else could use. The problem is they’re not prepared to pay for that luxury. So ultimately I’d suggest that 802.15.4g may fail, simply because of that.

Hi again,

Thanks a lot for the view point.

In that debate, I was wondering whether IEEE 802.15.4g, endorsed by the WI-Sun alliance in my Utility vertical, was a viable alternative to the 3 other contenders you mentioned.

As you will see in the link below, there are some issues, in spite of the recent inclusion in the PHY layers of new modulations alternatives.

https://iotee.wordpress.com/2015/03/11/internet-of-things-connectivity-option-analysis-ieee-802-15-4-technologies/

The author here concludes negatively, due to coexistence management with other 802.15.4 flavours.

Any take on that ?

Thanks in advance

jp

Beware of bets. WiMax had lots of supporters, as did WiMedia. Further back there were plenty of people supporting HiperLAN and HomeRF. However good a technology, the power of the ETSI/3GPP standards is immense because they are so easy to deploy. There is certainly a gap which LPWAN can fill, but it is naive to assume it will not still have an uphill struggle.

There’s no doubt that IPv6 is a trend. I wrote about it back in 2011 pointing out that it was almost becoming a religious war between the internet community and the mobile community. It’s not a new one. I have pre-ZigBee and Bluetooth documents from 2001 in which both claim it’s needed to get to the billions of connected devices, but neither adopted it for the next ten years. Which didn’t stop Bluetooth selling several billion chips last year.

It does makes life easier for programmers, very few of whom have any understanding of hardware or the practical issues of making really low power wireless sensors. So you could argue it’s a sop for the hardware illiterate. But on the other hand it makes it easier to manage devices in a large vertical organisation. That ought to be an important consideration. However, device management seems to be the poor relation of anything else in this new Internet of Things, and I suspect rather too much prominence is still given to ease of coding.

I don’t have too strong a view. If it helps you with commissioning and device management and power consumption is not a problem, consider using it. If power management or local connectivity is more important it might be better to ignore it. It tells you a lot that low power networks generally get to scale without it, because it can be an issue in terms of payload and power. I’m waiting to see where Sigfox and LoRa go with it. LTE and NB-IOT should not be a problem, but they will bring a different set of baggage with them.

I go back to my basic philosophy, which is look at the needs of the application, then look at how you intend to deploy and manage the devices. Once you’ve done that you’ll have a short list of connectivity options which are generally pretty obvious. Don’t start with the technology and bend your application to fit it.

Nick,

In my Utility vertical, IPV6 down to the end point has generated a lot of buzz lately, but as I review other verticals, I do not see people or companies communicating so much on IPV6 addressing.

Sigfox certainly cannot really support IPV6 overhead and is clear that they do not care,

Lora, is only a PHY and a MAC at this stage, but I assume the arrival of G. Mulligan as president of the alliance in recent times, could indicate that 6LowPan could be the next step for those guys,

LTE can support IPv6 of course

any POV on that ? Do you see IPV6 as a mega trend for all objects eventually ?

thanks

jp

Great article and valid comments. I just want to bring attention to the fact That LoRa chips have now two additional sources beyond SEMTECH (STm and Microchip). This will definitely secure the bet!

That last sentence seems to be a very important one for implementors to consider. Thanks for the comment.

Great piece.

A natural extension results from the very-low operator revenue per device: Network operators just don’t care about IoT.

I’d argue that, despite all press releases to the contrary, operators are happy to keep their focus on phones and cars and other high-revenue devices.

This is rational and not likely to change anytime soon. It means that building an IoT device or application on a cellular network is a risky proposition, since you’ll always be a second-class citizen when it comes to network upgrades or changes.

The risks also hold for any network technology that requires you to rely on a single network operator. It seems to me that the truly brilliant thing about LPWAN technology that operates on unlicensed spectrum is that you don’t need a network operator — anyone can drop down a gateway and cover a large area. Technologies that don’t provide this option will be at a distinct disadvantage.

Which is a big reason my team is betting on LoRa. I like that I can buy chips on Digikey, and tap into an existing MAC layer standard supported by a diverse community.

LoRa isn’t necessarily more open than other technologies, but it’s open in the important ways.

Your analysis is spot on, it’s a great summary of the situation.

Regarding Mr. Hassan comment, I think it’s important to note that the Sigfox and LoRaWAN protocols could be quite easily ported to licensed bands in complement of the unlicensed bands. That is true for telcos, that could recycle bands use for 2G, and for private operator that just want to deploy a cheap power-efficient local network on a reduced number of channels.

Additionally, LoRaWAN has build-in dynamic channel reallocation, and could be used in TV-white-spaces: gateways are location-aware and network management is centralized, making this easy to implement if/when the legal framework allows it.

On the business side, I agree, billing the final customer and managing SIMs will be a non-starter for telcos in the IoT world.

I strongly believe that service providers will be the key: on one end they sell a value-added service so they can bill the customer periodically (annually for ‘cheap’ services like data display and storage, monthly for more elaborate ones like complex analytics); on the other end they can buy bulk connectivity from the telcos, and at the end, everyone makes money 🙂

I don’t know the Link Labs solution. They say they’re “Building on the LoRa standard”, which is a phrase that always worries me a little, as it can mean adding proprietary extensions which make it less interoperable. But you’d need to check that for yourself – it could just be marketing speak.

Spectrum availability is definitely an issue. The 2.4GHz band is already getting threatened by adjacent cellular activity, and there’s no reason to suppose that the same thing won’t happen in the lower 868 and 910 MHz bands. They’re more tightly regulated, particularly in Europe, but that can be a problem as well as a blessing, as it reduces the available bandwidth.

At the end of the day, you need to make your own decision based on what is important for your customers and your business. That may be different depending on where you are and what you’re doing. The main thing I wanted to highlight is that the technology itself is probably the least important part of that decision.

Very informative.

I liked your argument and properly convinced with your bet on LoRa.

My only concern is that it is working on open spectrum which in the future may be too jammed and no one is regulating this.

see http://openlora.com/forum/viewtopic.php?t=61

http://forum.thethingsnetwork.org/t/who-owns-the-network/117

As you said I want to build my IoT now but I want to plan for future issues and risks as well.

What do you think of this issue and how can I avoid it?

Should I go for Link Labs Symphony?

Witty, brilliant even at times, and certainly a whole bunch of great insights,

As I reviewed over the past few days, all kinds of points of views on this cloudy LPWAN matter, this is the first paper I find where clarity and common sense has prevailed,

well done !

thanks

jp

I have had the chance to read your article and would like to flatter about the way you covered the market of LPWAN. The article is comprehensive and clear. It delivers your POV by providing a strong arguments that I personal deal with in my meetings with the eco-system.

Despite your preference for LoRa technology we, in Altair are trying to disrupt the market. We have done that by being among the first to introduce LTE Single Mode chipset solution and making this technology accessible and mature. We adopted the same path in the LPWAN industry and we surely need to make sure that our technology meet the same criteria mentioned in your article.

I don’t necessarily agree that data plans will have to be free of charge but for sure they should be extremely cheap. The traditional operators are debating and we are there to help them to better shape their future strategy.

However in 2016 not just the tectonic plates will drift – the IoT /M2M market in US and Europe will drift as well. On 1 th. of January 2017 we need a gravestone with “Rest in peace GSM”. AT&T in US will sun set GSM.

North America:

The American has no other chance than to order the much more expensive LTE and UMTS modules. LTE modules are up to 10 times more expensive than GSM modules. This is one reason why LPWAN technologies like LoRAWAN, Sigfox and Weightless will grow in US much faster. Weightless promise the the half price than for GSM.

Europe:

In Germany GSM will stay alive. The market share for new M2M SIM cards in Germany for LTE is 2 to 3%. In 2015 97% was on GSM. BTW, there is still no LTE M2M SIM card with roaming all over Europe available. I talk about European roaming and not world wide roaming. I gave my request on LTE M2M SIM cards to a big M2M SIM card provider. Since weeks I got no answer. We have in Europe one currency but no European LTE M2M network.

In 2016 the M2M business will rise for sure, but each company has to decide which piece of the IoT cake is the best.